Accounting for Real Estate, Construction and Hospitality Boulder, CO

Those standards require me (us) to perform procedures to obtain limited assurance that there are no material modifications that should be made to the financial statements. I believe that the results of my procedures provide a reasonable basis for our report. On average, individual tax preparation services cost $242, and prices typically range from $137- $454. However, many factors can impact how much an accountant will charge you for tax assistance.

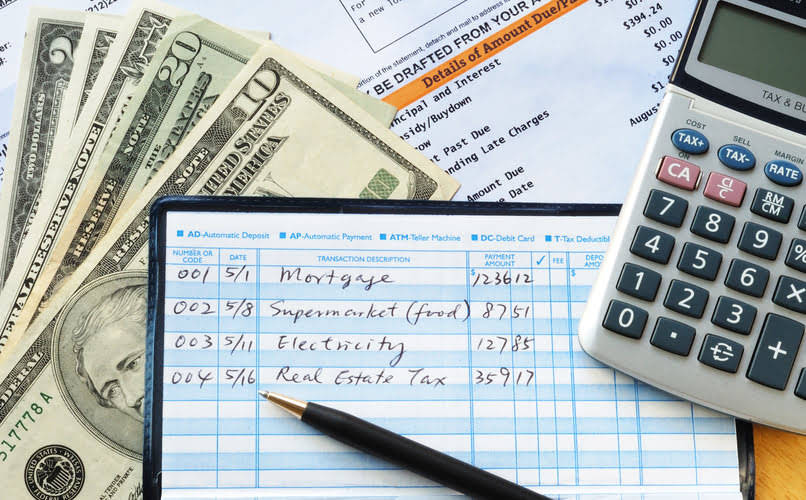

For more information and to see opportunities available in Boulder and across the country, visit our career page today. We have a deep understanding of the industry issues you are facing, whether you are looking to expand globally, engage in M&A or exit strategies, prepare for shifting regulations, transform your accounting functions or more. I remember years ago when Ian was managing a convenience store, he caught employees in cahoots with a vendor stealing product before it even came into the store. A cardinal rule is to trust your employees, but don’t give them the opportunity to abuse that trust. That means doing background checks on new employees, and putting measures in place to minimize problems. For control over money, the most important thing is to do bank reconciliations promptly.

Table of Contents

Clinician Experience Survey

Leeds has updated its accounting program and curricula to match the changing requirements of the Big Four accounting firms. Analytical skills are an increasing part of the curriculum, as are practical assignments that challenge students use data in solving accounting problems. Whether you want to work in accounting, audit, financial planning, forensic accounting or regulation, these new skills are paramount to long-term success. Origin CPA Group delivers accounting, tax, and consulting, including family office services, to ultra-wealthy individuals and families. We manage complex financial scenarios, so our clients can live their lives without the unique burdens that wealth can bring. Our clients receive high-quality service and tax expertise that considers their current needs as well as their visions for the future.

Opinion: No on 2A – Restricted funding limits Boulder’s financial flexibility – Boulder Beat News

Opinion: No on 2A – Restricted funding limits Boulder’s financial flexibility.

Posted: Fri, 20 Oct 2023 07:00:00 GMT [source]

We hope you’ll join us at one of the numerous community outreach and volunteer programs we proudly support. Because my accounting practice has “grown up” using Macintosh computers, I am familiar both with Macintosh and Windows operating systems. Today, there are a number of computer programs suitable for the small business that will provide both sets of information. I am a member of both the AccountEdge Professional Advisors Program and the QuickBooks Pro Advisors. An

accounting system is important to establish the financial component of that information.

Delivering first-rate accounting services since 2002

Examines the tax consequences of forming and operating regular corporations, partnerships, limited liability companies, and S corporations. BDO is the brand name for the BDO network and for each of the BDO Member Firms. BDO USA, P.C, a Virginia professional corporation, is the U.S. member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms. By keeping the books in good condition, you can be assured that reports you generate from them will give you current information you can use in running your business.

- It caters to businesses as well as individuals from different professions such as medical practitioners, dentists, real estate agents, and consultants.

- However, many factors can impact how much an accountant will charge you for tax assistance.

- Accounting 4 Business is run by Jeanine Buben, who is an accountant, a tax analyst, and an enrolled agent licensed by the U.S.

- We have a deep understanding of the industry issues you are facing, whether you are looking to expand globally, engage in M&A or exit strategies, prepare for shifting regulations, transform your accounting functions or more.

- My (our) responsibility is to conduct the compilation in accordance with Statements on Standards for Accounting and Review Services issued by the American Institute of Certified Public Accountants.

For an accurate price estimate, request quotes from several certified public accountants (CPAs) near you. Our graduates land competitive jobs in audit and assurance, risk management, consulting, and financial planning and analysis. boulder bookkeeping services Whether you’re seeking a career locally, nationally or globally, you’ll be a valuable asset to companies, public accounting firms, nonprofit organizations, and government agencies of every size and in nearly any place.

Bill Brooks, CPA

The team offers an extensive background with master’s degrees in Taxation, Accounting, and Business Administration and certifications such as Personal Financial Specialist and Enrolled Agent. Accountants’ rates vary based on their education, licenses, experience, and the work for which they are being hired. An accountant may charge https://www.bookstime.com/ an hourly rate when a company or individual needs their services on a short-term basis, such as when performing an audit or requesting assistance setting up a financial database or process. Hourly rates can range as widely as $40 per hour to $300 or more per hour, depending on your geographic location and the accountant.

- Studies federal income taxation related to taxable corporations, the entities through which a large part of the economic activity in the U.S. is conducted.

- Studies federal income taxation of pass-through entities such as those used by most small businesses in the U.S.

- Integrated reporting combines financial, environmental, social and governance information into a single report.

- Focuses on the use of accounting information by decision makers external to the firm.

- Using a traditional accounting toolkit and analytical techniques, they build models to find trends, identify better investment opportunities and make smarter recommendations.

- BDO’s comprehensive portfolio of accounting, assurance, tax and advisory services can help manufacturers with all their business needs, from supply chain management to implementing Industry 4.0 technology and beyond.

Our national and global resources are here to help you chart additional strategies for success. Lenders and investors often will want more assurance that your business is what you say it is than just accepting the print out of reports from your accounting program. Sometimes you maintain your business records on the income tax basis or cash basis of accounting, but they want “Generally Accepted Accounting Principles” (GAAP).

MagicByte Solutions work-round the clock to get the client’s brand recognized on a global front. We channelize the digital efforts of brands to boost relevant traffic and to increase the visibility of the business on top search engines like Google and Bing. Our spectrum of digital marketing services helps the company to reach the right hands and new heights.